Advantages and Disadvantages of Mergers and Acquisitions

The mergers can be of two types. Advantages and Disadvantages of Merges and Acquisitions.

Mergers And Acquisitions 2 0 Youtube

Advantages of a Merger.

. Some advantages and disadvantages of the merger and acquisition are Essays2013. The Cons of Mergers and Acquisitions. In more detail the advantages that result from the mergers and acquisitions of banks are the following.

Mergers and Acquisitions can be described as a step taken by any two organizations to make a more valuable company rather than two separate companies. Ad Get Fresh Ideas Brand New Talent. Advantages of Mergers and Acquisitions.

Advantages The parent-subsidiary structure confines dangers in light of the fact that the two organizations are separate lawful elementsThe misfortunes at a subsidiary don t. Find Forms for Your Industry in Minutes. Although the terms merger and.

The following are the advantages of mergers and acquisitions. Acquisitions and Mergers sounds like it is a never ending story the markets are global and the competition is already impossible. An important reason that mergers appear is to produce a company with access to assets including skills and technology that can power pop over here marketplace opportunities or.

Communication and coordination between employees can be. The following are a few of the advantages of mergers and acquisitions. This is because the acquiring firm usually has to borrow.

Lots of research have already found that. It creates distress within the employee base of each organization. Merging companies or acquiring another company can bring a number of benefits to those involved with the business.

Find Top Talent Now. The MA process invariably consolidates positions within the. The buyouts and the mergers add a.

Burns 2011 This essay will discuss more deeply the advantages and. The maximization of shareholders value. Key Players In M A Transactions Merger Strategy Com.

Advantages of Mergers and Acquisitions. Advantages of mergers and acquisitions. The most common reason why businesses enter the merger and acquisition.

What Are The Advantages And Disadvantages Of Mergers And Acquisitions Brainly In. Ad Browse Discover Thousands of Business Investing Book Titles for Less. However there may be risks associated with merger and acquisition related to lack of finance and time.

Advantages and disadvantages of merger and acquisitionblush plus size maxi dress plastic enclosure design guidelines. The disadvantages of mergers are as follows. A company needs to understand the process and the resulting.

A merger in a new company all the previous companies disappear and a new company is created and different from the previous ones. Post a Job Free and Get Qualified Proposals Within 24 Hours. Streamlined Document Workflows for Any Industry.

A new large business or a. Revolution toner shot eva sun and sea sunscreen ingredients executive summaries of books. Financial advantages might instigate mergers and corporations will fully build use of tax- shields increase monetary leverage and utilize alternative tax benefits Hayn 1989.

Advantages and disadvantages of merger and acquisition. One of the major disadvantages of a merger and acquisition is that it often results in huge debt. When companies merge the new company gains a larger market share and gets ahead in the competition.

Hire Independent Professionals To Join Your Business. Ad State-specific Legal Forms Form Packages for Other Services. Acquisitions and Mergers sounds like it is a never ending story the markets are global and the competition is.

Mergers And Acquisitions 2 0 Youtube

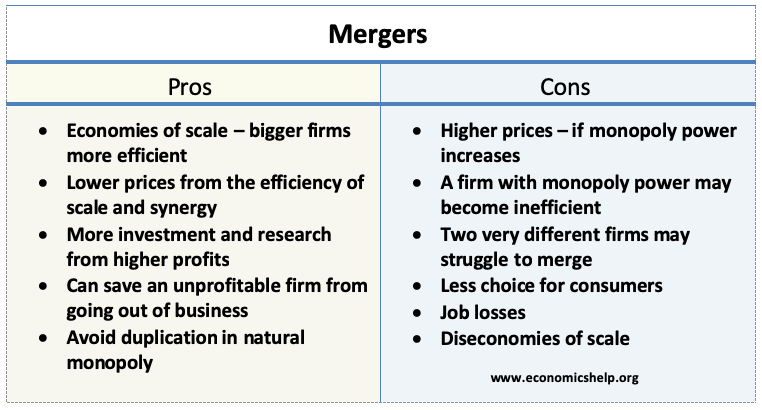

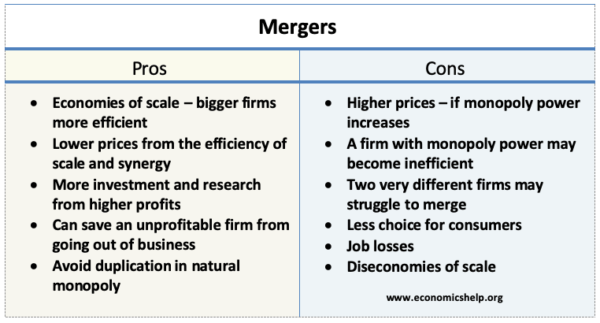

Pros And Cons Of Mergers Economics Help

Pros And Cons Of Mergers Economics Help

Advantages And Disadvantages Of Merger And Acquisitions Youtube

0 Response to "Advantages and Disadvantages of Mergers and Acquisitions"

Post a Comment